How to Support the NRO

your support counts!

Ways to Give

When you contribute to NRO, you’re not just supporting a performance, you’re investing in the future of classical music. Over 70% of our budget comes from charitable giving, ensuring that professional musicians have life-changing opportunities and enabling us to offer innovative education and community engagement programs for all ages and abilities.

As a valued donor, we want to show our appreciation for your support. When you donate to the NRO you will be recognized in our Season Program Book annually.

Your generosity, in any amount, is appreciated and truly makes a difference.

online

Your donation just how you want it to be. We appreciate the generosity of all of our donors!

To make a gift by mail, please send your check, made payable to:

National Repertory Orchestra

PO Box 6336

Breckenridge, CO 80424

discuss your options

If you would like to learn more about how to make your gift, please contact:

Åsa Armstrong

Director of Development

[email protected]

(970) 453-5825 x3

Donor Benefits

There are many ways to make a tax-deductible, immediate, tangible difference to the future of classical music by giving to the NRO. As a valued donor, we want to show our appreciation for your support.

Smart giving from your simple ira

Make a difference today and save on your taxes! It is possible when you support the NRO through your IRA. Explore how to get the most out of charitable giving.

In-Kind Gifts

Donations of goods and services are impactful ways to support the Orchestra you love. To learn more about in-kind giving, please contact Åsa Armstrong at 970-453-5825 x3 or [email protected].

Planned Giving

Create a lasting legacy that will ensure the future of the National Repertory Orchestra while addressing your personal philanthropic and financial goals.

Foundation & Grant Support

Support from charitable foundations, trusts and public agencies sustains the NRO’s mission of Changing Lives Through Music!

Gifts of Stock

With your gift of stock to the National Repertory Orchestra, you receive tax benefits while supporting the future of classical music! Your broker or investment advisor can wire your gift to the NRO quickly and safely by using the Depository Trust Company (DTC) wire transfer system.

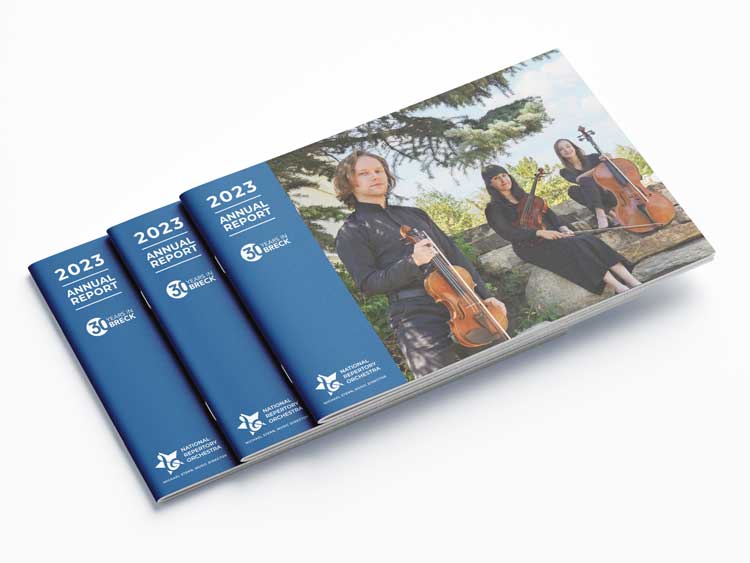

Annual Report

The Annual Report outlines the National Repertory Orchestra’s financial health, mission achievements, and impact over the past year. Learn more about how we are achieving our mission of Changing Lives Through Music!

Frequently Asked Questions

Over 70% of the NRO’s budget comes from charitable giving, providing life-changing experiences for professional musicians, innovative education and community engagement programs for all ages and abilities and outstanding orchestral performances at affordable ticket prices.

As an NRO donor, you will be recognized in the Season Program Book annually, unless otherwise noted, at your giving level. All gifts can be made in honor or memory of special individuals. Your generosity, in any amount, is appreciated and truly makes a difference.

What Does Donating Online Offer Me?

It provides an easy, convenient way to donate to our mission, and reduces our fundraising costs. Plus, by donating with your credit card, you can use your credit card statement for taxes/receipts, earn credit card rewards, save time and reduce postage costs.

How Does Online Donation Work?

Simply fill out all the fields on our secure donation form, click “Submit” and your donation will be processed immediately. A summary of the donation will appear on the screen for you to print, plus you will be emailed an acknowledgement.

Do You Need My Personal Information To Donate?

Yes, in order to process payments, your information is required. The service we offer operates on a secure server and complies with Visa/MasterCard regulations for real-time credit card processing. Unless you’re participating in our Recurring Gifts program, your credit card information will not be kept on file. Your other personal information is entered into a security-protected donor management system that only authorized users may access.

When Will My Credit Card Be Charged?

We use a real-time authorization service, so a charge will be seen on your account within 24 hours.

What Credit Cards Do You Accept?

Master Card, Visa, Discover and American Express

What If My Credit Card Is At The Limit When My Card Is Charged?

This service depends on you having enough available credit for the charge to be accepted. If your credit card does not have enough available credit, the donation could be denied by your credit card company and your donation may not be made.

Will I Receive A Receipt?

Yes. We will mail you an acknowledgement / thank-you for your records. You can also print the authorization information on the final screen after your donation. The donation will appear on your credit card statement.